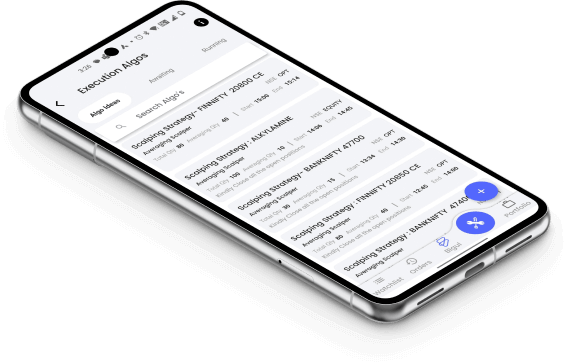

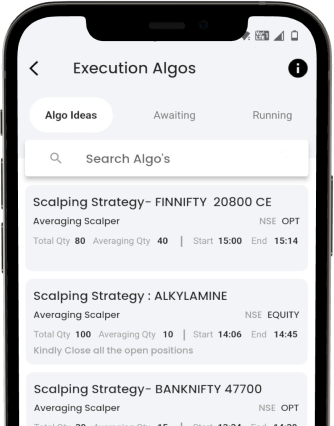

Algo Trading tool, Bigul Algos revolutionises trading by automating traditional practices. It significantly reduces risks linked to manual trading such as emotional biases and input errors.

Bigul Algos provides a systematic, consistent approach, ensuring reliability in returns across various risk profiles and trading styles. With pre-built strategies, Bigul Algo minimises manual input errors, enhancing trade accuracy and efficiency.

Bigul Algos platform caters to all types of traders, from conservative to aggressive, offering tailored strategies that align with individual goals.

By automating strategy execution, Bigul Algos ensures a methodical trading experience, fostering a reliable framework for success in the dynamic trading environment.

Bigul Algos excels in providing traders with a reliable and methodical framework. By offering a variety of pre-built trading strategies, Bigul platform serves the diverse preferences and risk appetites of individual traders.

Whether you are a conservative investor seeking steady returns or a more aggressive trader comfortable with higher risks. Bigul Algos understands your needs, allowing you to align your trading approach with your specific goals.

User-Friendly Strategy Templates

User-Friendly Strategy Templates