Bigul Mutual Funds

Bigul Mutual Funds is your gateway to smarter, data-driven investing. Our platform empowers you to analyze, compare, and plan mutual fund investments with confidence. Whether you’re a first-time investor or looking to optimize your portfolio, Bigul Mutual Funds helps you make informed decisions, manage risk, and grow your wealth with clarity and ease.

The purpose of Bigul Mutual Funds is to provide a comprehensive solution for evaluating and managing mutual fund investments. By leveraging advanced analytics and real-time insights, our platform helps you identify top-performing funds, assess diversification, and monitor your investments for optimal performance. We make it easy to spot opportunities, address underperformance, and take action to improve your financial outcomes.

Unified SEBI Regn. No.: INZ000212137 | SEBI Regn. No. DP: IN-DP-62-2015 | CIN: U65991DL1993PLC052280 | Research Analyst ID: INH100001666

Compliance officer - Ms. Trupti Milind Khot

Our Services

Discover a smarter way to grow your wealth—Bigul Mutual Funds empowers you to evaluate, compare, and invest with confidence, using research-backed insights tailored to your goals.

Evaluate

Assess your current mutual fund portfolio with advanced analytics and intuitive calculators. Understand your holdings, identify gaps, and project future growth to make informed, goal-oriented decisions.

Compare

Instantly compare a wide range of mutual funds across categories and strategies. Analyze performance, risk, fees, and portfolio composition side-by-side to find the best fit for your unique investment needs.

Invest

Go beyond the basics—our Fund Analyser leverages both historical data and forward-looking research to help you choose from funds with strong prospects to maximize your returns, not just based on the past, but on where the markets are headed.

This approach ensures you’re always a step ahead—evaluating your current position, comparing the best opportunities, and investing for tomorrow’s growth.

Key Features

- Invest instantly with a few taps

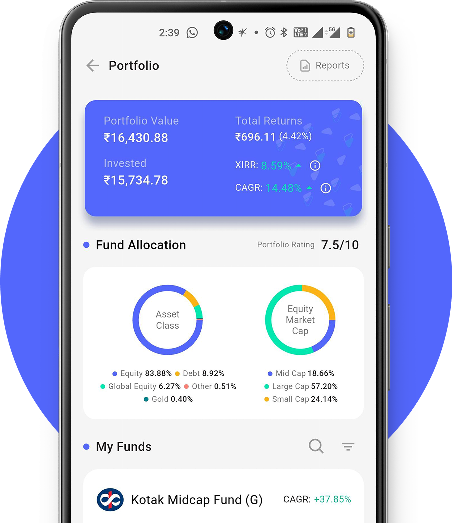

- View portfolio performance at a glance

- Set up flexible SIPs easily

- Track investments, returns, and holdings

- Explore top funds across categories

- View expert fund ratings before investing

- Find funds using advanced filters

- Enjoy hassle-free fund redemption

- View detailed transaction logs instantly

- Download reports with a single click

Invest Smarter with Fund Analyzer

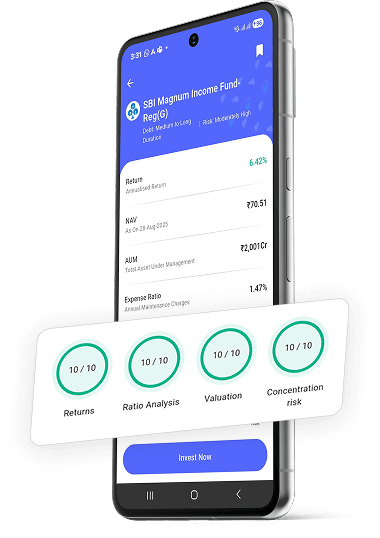

Our Fund Analyser leverages advanced technical and fundamental analysis to evaluate mutual funds. Here’s how it works:

- Analyze Performance: Review historical returns, risk metrics, and diversification.

- Personalized Scoring: Get a fund score tailored to your risk appetite and goals.

- Visual Insights: Instantly visualize fund composition, sector allocation, and performance trends.

- Actionable Recommendations: Receive data-backed suggestions to optimize your mutual fund portfolio

- Seamless Experience: Access all insights and actions directly from the Bigul app, with a quick video walkthrough for instant clarity.

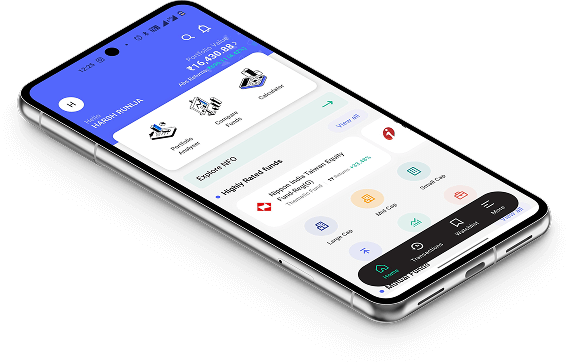

All-In-One Mutual Fund App

Comprehensive Fund Analysis

Access in-depth analysis powered by AI and expert research. Our platform evaluates funds across multiple parameters, giving you a clear picture of performance and risk.

Side-by-Side Fund Comparison

Effortlessly compare funds to make smarter choices. See how different options stack up on returns, risk, and costs, so you can invest with confidence.

Goal-Based Calculators

Use our calculators to plan and track your investments. Estimate future value, set SIP amounts, and align your portfolio with your financial objectives.

Personalized Recommendations

Receive fund suggestions tailored to your risk profile and investment goals. Our recommendations are designed to help you achieve better outcomes.

Transparent, Easy-to-Use

Enjoy a seamless experience with a platform built for all investors. Navigate, analyze, and invest with ease, whether you’re a beginner or an expert.

Download Bigul MF App!

Supercharge your trading on the go with the Bigul MF App! Download now for instant access to cutting-edge features, real-time insights, and unparalleled convenience.

FAQs

- Install the app from the Play Store and App Store

- Complete your KYC (if not already done)

- Select mutual funds based on your goals

- Invest via SIP or lump sum

- Equity Funds

- Debt Funds

- Hybrid Funds

- ELSS (Tax-saving) Funds

- Index Funds

- Go to your portfolio in the app

- Select the scheme you wish to redeem

- Enter the units/amount

- The redemption amount will be credited to your registered bank account within T+3 working days (depending on the fund type)