Disclaimer: This research report has been published by M/s. Bonanza portfolio Ltd and is meant solely for use by the recipient and is not for circulation. This document is for information purposes only and information / opinions / views are not meant to serve as a professional investment guide for the readers.... Reasonable care has been taken to ensure that information given at the time believed to be fair and correct and opinions based thereupon are reasonable, due to the nature of research it cannot be warranted or represented that it is accurate or complete and it should not be relied upon as such. If this report is inadvertently send or has reached to any individual, same may be ignored and brought to the attention of the sender. Preparation of this research report does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Past performance is not a guide for future performance. This Report has been prepared on the basis of publicly available information, internally developed data and other sources believed by Bonanza portfolio Ltd to be reliable. This report should not be taken as the only base for any market transaction; however this data is representation of one of the support document among other market risk criterion. The market participant can have an idea of risk involved to use this information as the only source for any market related activity. The distribution of this report in definite jurisdictions may be restricted by law, and persons in whose custody this report comes, should observe, any such restrictions. The revelation of interest statements integrated in this analysis are provided exclusively to improve & enhance the transparency and should not be treated as endorsement of the views expressed in the analysis. The price and value of the investments referred to in this report and the income from them may go down as well as up. Bonanza portfolio Ltd or its directors, employees, affiliates or representatives do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information / opinions / views. While due care has been taken to ensure that the disclosures and opinions given are fair and reasonable, none of the directors, employees, affiliates or representatives of M/s. Bonanza portfolio Ltd shall be liable. Research report may differ between M/s. Bonanza portfolio Ltd RAs and other companies on account of differences in, personal judgment and difference in time horizons for which recommendations are made. Research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an officer, director or employee of the subject company. Research analysts have not received any compensation/benefits from the Subject Company or third party in connection with the research report. Read More ▼

Nifty Defence

Sector Overview

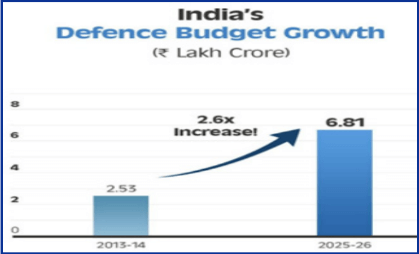

India stands as the third-largest military spender globally as of FY23, with its defence budget comprising 2.2% of the national GDP. This is comparable to other major economies: the USA (3.5%), Russia (4.1%), France (1.9%), and China (1.6%). The Indian government plans to invest approximately USD 130 billion between FY24 and FY30 for fleet modernisation across all branches of the armed forces, reflecting a projected CAGR of ~7%, slightly outpacing the estimated GDP growth rate of ~6.5% over the same period. For FY24 alone, the allocated defence budget was USD 70 billion.

Stocks In Nifty Defence Sector:

| Company Name | Weightage (%) |

|---|---|

| Hindustan Aeronautics Ltd. (HAL) | 28.82 |

| Bharat Electronics Ltd. (BEL) | 24.36 |

| Solar Industries India Ltd | 12.63 |

| Mazagon Dock Shipbuilders Ltd | 12.17 |

| Bharat Dynamics Ltd. (BDL) | 6.4 |

| Cochin Shipyard Ltd | 4.44 |

| Zen Technologies Ltd | 1.67 |

| BEML Ltd. | 1.53 |

| Data Patterns (India) Ltd | 1.38 |

| Astra Microwave Products Ltd. | 0.9 |

Major Developments in India’s Defence Sector

- Indigenous Defence Production Surge: India has made significant progress in achieving self-reliance in defence manufacturing, reducing dependence on imports, exemplified by Positive Indigenisation Lists.

- In FY 2023-24, India's indigenous defence production reached ₹1.27 lakh crore, up by 16.7% from 2022-23.

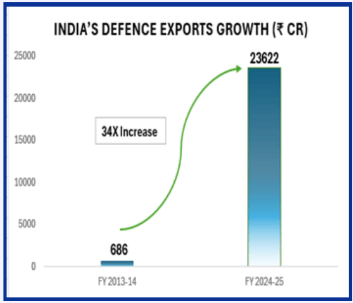

- Defence Exports Expansion: India's defence export sector has experienced unprecedented growth, positioning the country as a key player in the global arms market.

- Technological Advancements in Defence R&D: The focus on technological innovation through iDEX (Innovations for Defence Excellence) and the Technology Development Fund (TDF) has spurred India’s technological self-reliance

Mixed performance in 4QFY25

- In Q4 FY25 (Jan-Mar 2025), India’s defense sector sustained its growth momentum, fueled by the “Aatmanirbhar Bharat” initiative, a ₹6.22 lakh crore defense budget, and ambitious export targets of ₹50,000 crore by FY29.

- Bharat Electronics Ltd. (BEL) reported a 31% YoY net profit increase with a ₹71,650 crore order book, driven by demand for missile and electronic systems.

- Paras Defence saw a 97.6% YoY profit surge to ₹197.2 million and 35.5% revenue growth to ₹1.08 billion, boosted by optics and sensor demand.

- Hindustan Aeronautics Ltd. (HAL) lacked specific Q4 data but showed strong half-year income growth and a ₹94,000 crore order book, despite a possible profit dip.

- Mazagon Dock Shipbuilders’ stock rallied on naval contract optimism, while Sika Interplant and Bharat Dynamics Ltd. (BDL) contributed to sector strength, with the latter benefiting from missile exports.

- Overall, robust order books, government support, and a 55% YoY NSE defense index rise in 2024 underscored the sector’s strong performance, though high valuations remain a concern.

Key points:

- In 2024-25, defence exports reached ₹15,233 crore from the private sector and ₹8,389 crore from DPSUs, up from ₹15,209 crore and ₹5,874 crore in 2023-24.

- DPSU exports grew by 42.85% in 2024-25, showcasing the increasing global acceptance of Indian defence products and industry integration into the global supply chain

- The Department of Defence Production issued 1,762 export authorisations in 2024-25, up from 1,507 in 2023-24, registering a 16.92% growth, while the number of exporters increased by 17.4% during the same period

- India now exports defence equipment to over 100 countries, with the USA, France, and Armenia emerging as the top buyers in 2023-24

- 65% of defence equipment is now manufactured domestically, a significant shift from the earlier 65-70% import dependency, showcasing India's self-reliance in defence.

- A robust defence industrial base includes 16 DPSUs, over 430 licensed companies, and approximately 16,000 MSMEs, strengthening indigenous production capabilities.

- India targets ₹3 lakh crore in defence production by 2029, reinforcing its position as a global defence manufacturing hub.

Mixed performance in 4QFY25

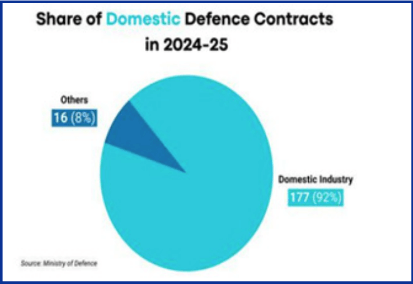

- The Ministry of Defence has signed a record 193 contracts in 2024-25, with the total contract value surpassing ₹2,09,050 crore, nearly double the previous highest figure. This milestone reflects the government’s commitment to strengthening national security through enhanced procurement and modernisation of the Armed Forces

- Of these, 177 contracts, accounting for 92 percent, have been awarded to the domestic industry, amounting to ₹1,68,922 crore, which is 81 percent of the total contract value. This significant focus on indigenous manufacturing aligns with the vision of self-reliance in defence production, boosting local industries and generating employment across the sector

Fundamentals

| Metric | Corrected Value |

|---|---|

| P/E Ratio (Price/Earnings) | 77.23 |

| P/B Ratio (Price/Book) | 13.5-15.58 |

| Dividend Yield | 0.25-0.44 |

Recent Orders Received:

| S.No | Order Name | Value (₹ Cr) | Date | Manufacturer | Associated Companies (Across Sectors) |

|---|---|---|---|---|---|

| 1 | Light Combat Helicopters (LCH) – "Prachand" | 62,000 | By Mar 31, 2025 | HAL | BEL (avionics), MTAR Tech (aero components), BEML (chassis/gear), Tata Elxsi (software), Hindalco (aluminium) |

| 2 | Pinaka MBRL Systems | 10,147 | Feb 6, 2025 | EEL & Munitions India Ltd | Solar Industries, Premier Explosives, Godrej & Boyce, Tata Steel, Aegis Logistics (chemicals supply) |

| 3 | K9 Vajra-T Howitzers | 7,628.70 | Dec 20, 2024 | Larsen & Toubro (L&T) | Bharat Forge, Tata Advanced Systems, JSW Steel, SKF India (bearings), BEL, Tata Power SED |

| 5 | Invar Anti-Tank Missiles | 3,000 | May-25 | BDL | Paras Defence, Data Patterns, Astra Microwave, Sika Interplant, Ratnamani Metals, IIFL Finance (offset enabler) |

| 6 | Shakti Electronic Warfare Systems | 2,269.54 | Feb-25 | BEL | Centum Electronics, Tata Elxsi, Syrma SGS, Cyient, Tata Communications (cyber infra), HFCL (network gear) |

| 7 | Akashteer Air Defence Systems | — | 2025 (planned) | BEL | Zen Technologies, Paras Defence, Astra Microwave, Bharat Forge, Tata Consultancy Services (integration) |

| 8 | ATAGS Howitzers | 7,000 | Mar 2025 (cleared) | Bharat Forge & Tata Group | L&T, JSW Steel, Welspun, Honeywell Automation, Bosch, Godrej Aerospace, Tata Steel |

| 10 | NWJ Fast Attack Craft | — | Dec 3, 2024 | GRSE | Cochin Shipyard, L&T Shipbuilding, Kirloskar Brothers (marine engines), GE India, ABB India |

| 11 | AEW&C Systems | — | Mar 2025 (cleared) | Likely DRDO + HAL | BEL, Data Patterns, Astra Microwave, HCL Tech, Infosys, Cyient, Zensar, HFCL, L&T Tech |

| 12 | Nibe Ltd – Israeli Defence Order | 150.6 | May 26, 2025 | Nibe Limited (via Israeli OEM) | Paras Defence, Astra Microwave, Godrej, Sterlite Technologies, Syrma SGS, Mold-Tek Packaging |

Key Triggers

- Expected Order Announcements: The Ministry of Defence is likely to finalize or announce key orders under capital procurement plans

- Geopolitical Tensions: Border activity with China and developments in West Asia are pushing sentiment in favour of defence preparedness

- Media Coverage & Investor Interest: Positive coverage on Make in India achievements, and interviews from MoD officials expected mid-week

- May-end Government Spending Data: Capex figures may show increased MoD disbursements, supporting near-term bullishness

Comparison Between Nifty And Defence sector

This indicates that defence sector stocks significantly outperformed the broader market. The surge could be attributed to positive news, sector-specific developments, or increased investor interest in defence-related companies. The steady performance of the Nifty 50 reflects overall market stability, while the spike in the Nifty India Defence index suggests bullish sentiment in that particular segment

Research-backed conclusions

-

India’s Defence Sector Has Entered a Structural Growth Phase

The combination of rising budget allocations, consistent policy support, and a clear focus on indigenization signals that this sector is not riding a short-term trend—it is in the early stages of a long-term structural uptrend. With a ₹3 lakh cr production target by 2029 and strong global demand, defence is evolving into a core growth engine for India's manufacturing and exports -

Export Boom Could Be the Game Changer

India's emergence as a defence exporter to over 100 countries, with a 43% rise in DPSU exports, suggests a pivot from being a buyer to a seller in global defence. This trend, if sustained, can improve sectoral margins, reduce forex dependence, and enhance strategic positioning globally -

Valuations Are Rich but Justified by Long-Term Potential

Despite high P/E and P/B ratios (P/E: 77.23), valuations appear justified given the sector’s strategic importance, steady cash flows, strong order books, and future potential. However, staggered investment or buying on dips is advised, especially after sharp rallies -

Tactical Opportunities Exist Amid Strategic Growth

Stocks like BEL, HAL, and BDL are not just long-term bets but also offer tactical trading opportunities due to positive technical patterns, news flow, and regular order inflows. With key capex data and procurement announcements expected, the sector remains in focus both fundamentally and technically.

Tanisha Mulewa

Digitally signed by Tanisha Mulewa Date: 2025.06.07

Disclaimer: This research report has been published by M/s. Bonanza portfolio Ltd and is meant solely for use by the recipient and is not for circulation. This document is for information purposes only and information / opinions / views are not meant to serve as a professional investment guide for the readers.... Read More ▼