Nifty & Bank Nifty - 16-12-2025

Latest Podcast

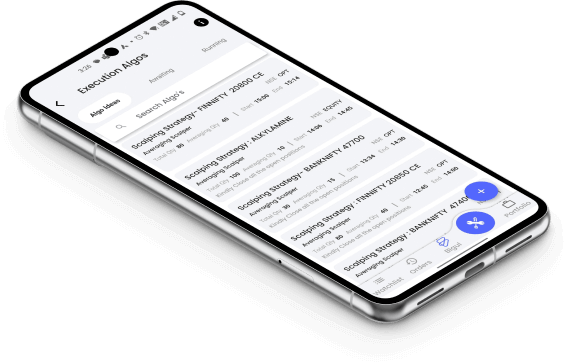

Download Bigul Trading App!

Supercharge your trading on the go with the Bigul Trading App! Download now for instant access to cutting-edge features, real-time insights, and unparalleled convenience.

FAQs

Discover all you need to know effortlessly with our frequently asked questions—your go-to resource for answers.

Daily market outlook is a detailed statistical collection of reports of market

behavior updated on a daily basis on various sectors i.e. forex,

indices, agri-commodity, metals & energy. You will be getting daily technical

outlook as well as Market mood and an audio which will explain everything

in detail.

Yes, all the reports get updated on a daily basis as we offer and updated

reports so that, you can make corrective investment decisions on time.

Yes, in addition to written analysis, we offer audio insights where key market

points are discussed.

No, we offer these reports free of cost to everyone.

Market mood refers to the overall sentiment or psychology of traders and

investors in the market. Our reports assess market mood to gauge sentiment and

potential market direction.

Absolutely. Our reports provide an in-depth analysis of agricultural

commodities, highlighting key trends, price movements, and factors influencing

the market.

It is important to stay updated in the market to make the correct investment

decisions , as market outlook reports will be beneficial for individuals who

are making future investment decisions.

Our experts use a variety of technical analysis techniques, including chart

patterns, indicators, and statistical models, to provide insights into market

trends and potential price movements.

Subscribe now to get

latest market updates

Close

.jpg)

.jpg)

.jpg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpg)